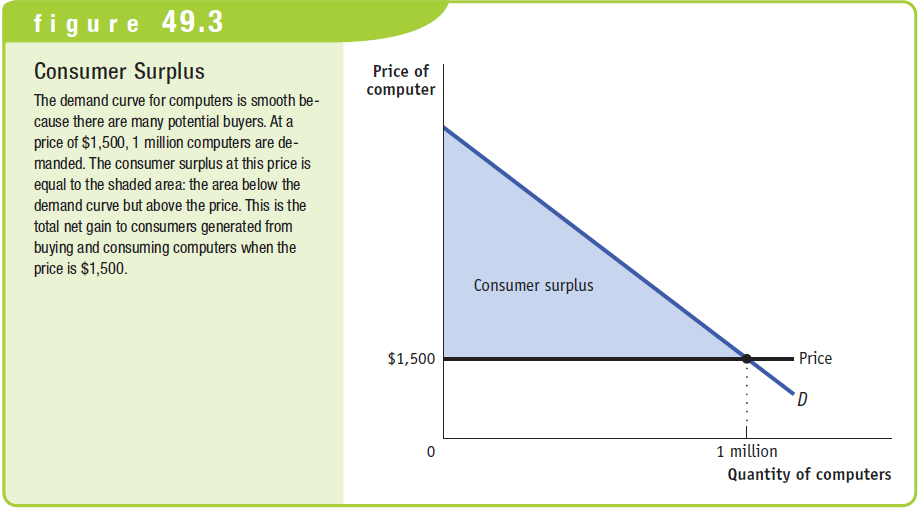

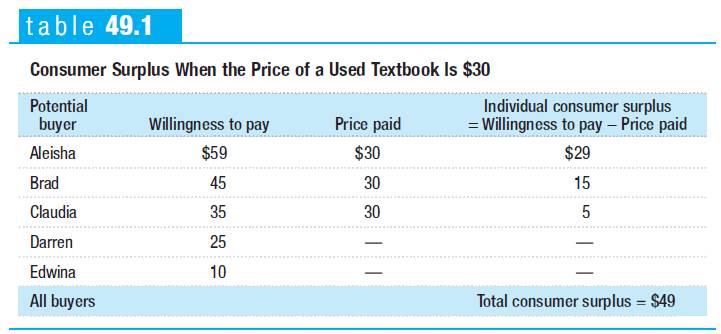

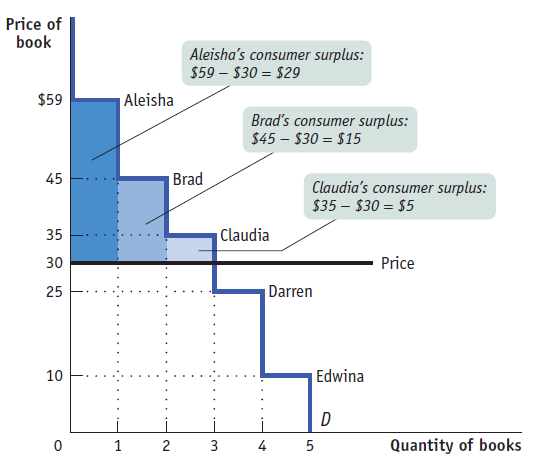

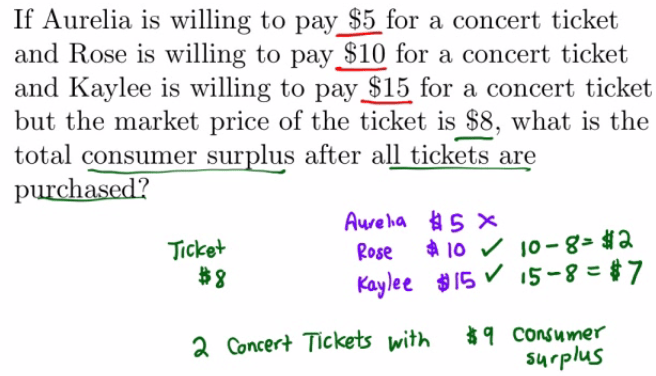

Consumer Surplus

Meaning

- the difference between the buyer's willingness to pay versus what he actually pays

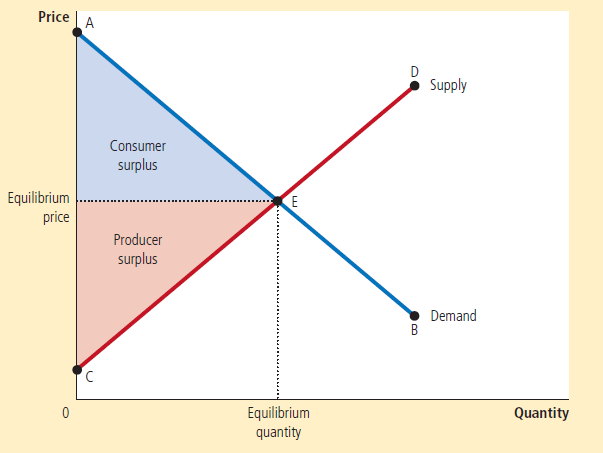

Graph

- On a supply and demand graph, the area of consumers surplus (CS) is below the demand curve but above the equilibrium price

- Example 1

Example 2

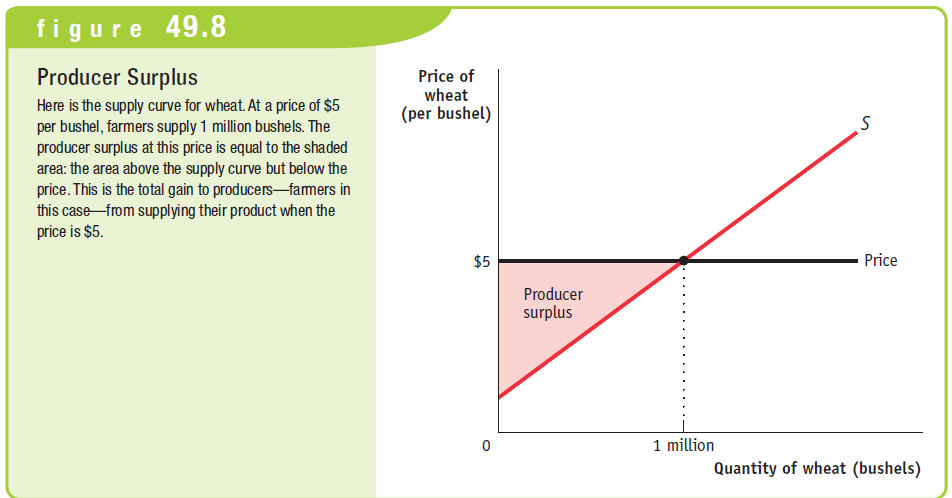

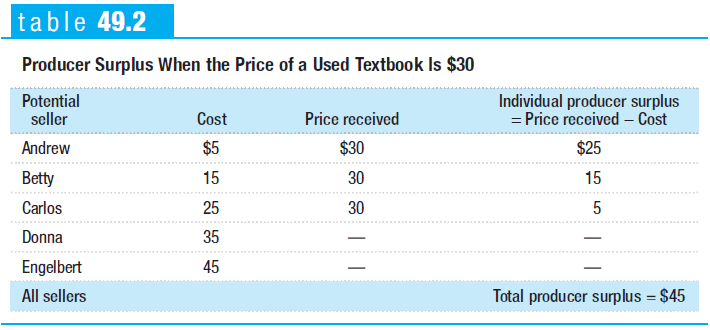

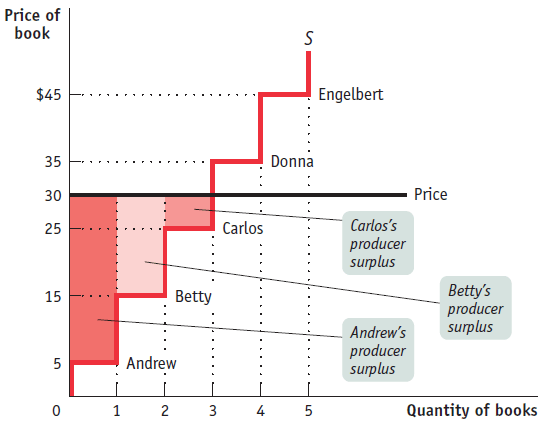

Producer Surplus

Meaning

- the difference between the price a sellers pays for and what he was actually willing to sell for

Graph

- On a supply and demand graph, the producer surplus is above the supply curve but below the equilibrium price.

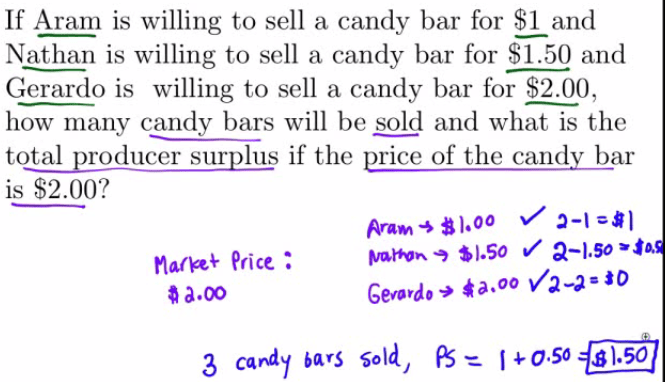

Example 1

Example 2

Total Surplus

Meaning

- the sum of consumer and producer surplus

Graph

- the area between the supply and demand curves up to the equilibrium quantity

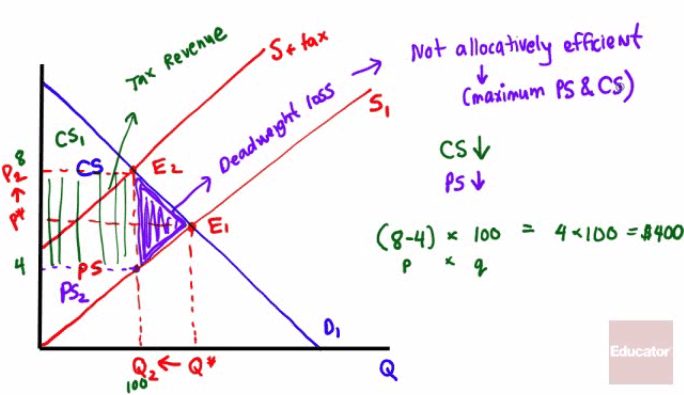

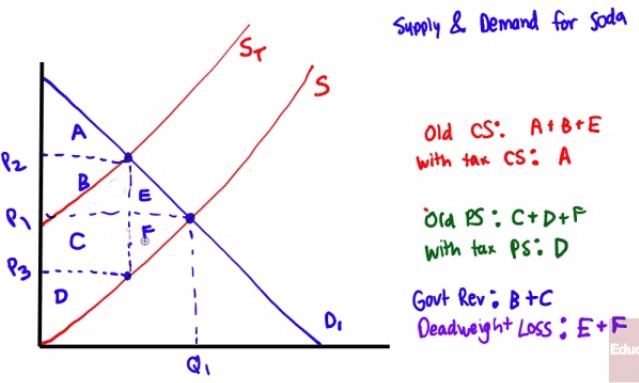

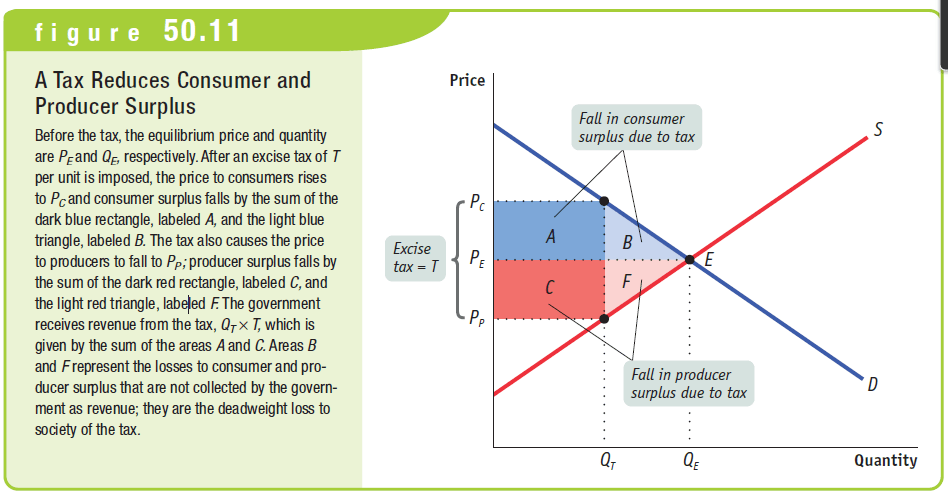

Effects of Taxes on Surplus

How does a tax affect hotel owners?

An excise tax on hotel owners will shift the supply curve to the left

The equilibrium price will be higher and the equilibrium quantity will be lower

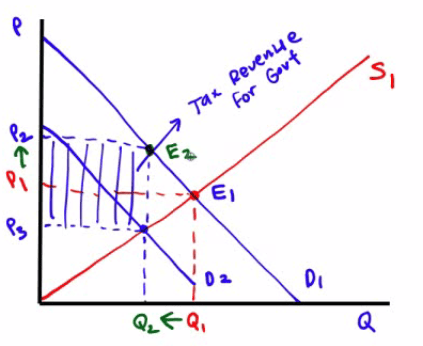

How does a tax effect hotel guests

An excise tax on hotel guests will shift the demand curve to the left

The equilibrium price will be higher and the equilibrium quantity will be lower

The tax incidence in both cases are identical

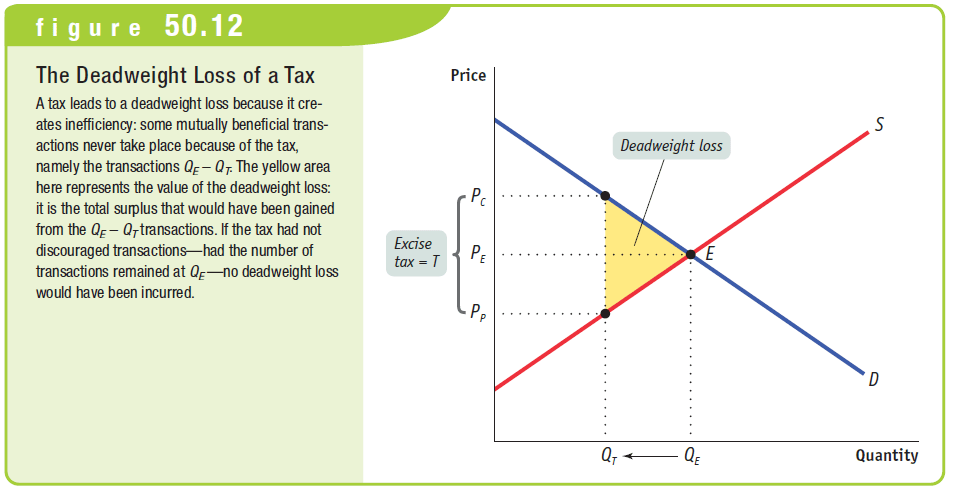

How the imposition of a tax will decrease consumer and producer surplus

- Deadweight loss

International Trade

Autarky

- the quality of being self-sufficient with no imports or exports, a closed economy

Free trade and Tariffs

Free trade increases total surplus

Tariffs serve to reduce allocative efficiency

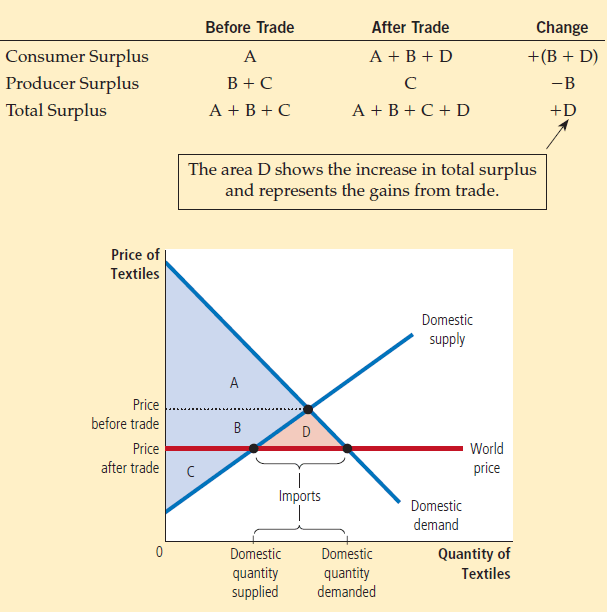

Importing Countries

The World Price (Pw) will be below the autarky price and total surplus will increase

Domestic consumers gain, domestic producers lose, but the net gain is positive

Buyers are better off (consumer surplus rises from A to A

- B + D)

Sellers are worse off (producer surplus falls from B + C to C)

Total surplus rises by an amount equal to area D

Trade raises the economic well-being of the country as a whole.

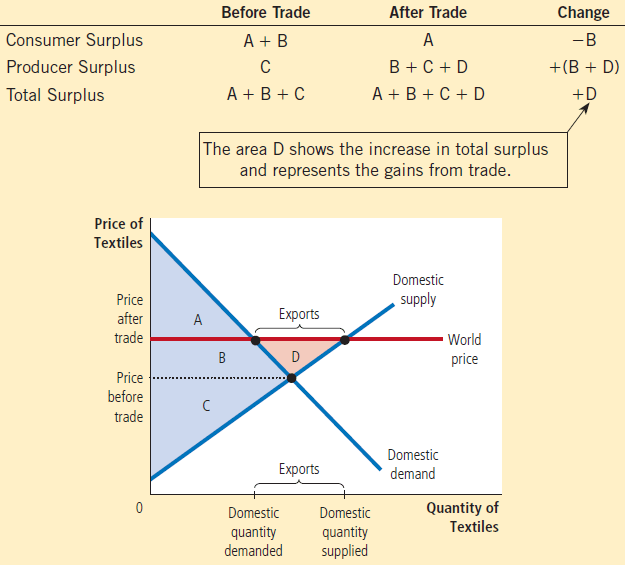

Exporting Countries

The World Price (Pw) will be above the autarky price and total surplus will increase

Domestic consumers lose, domestic producers gain, but the net gain is positive

Sellers are better off (producer surplus rises from C to B

- C + D)

Buyers are worse off (consumer surplus falls from A + B to A)

Total surplus rises by an amount equal to area D

Trade raises the economic well-being of the country as a whole.

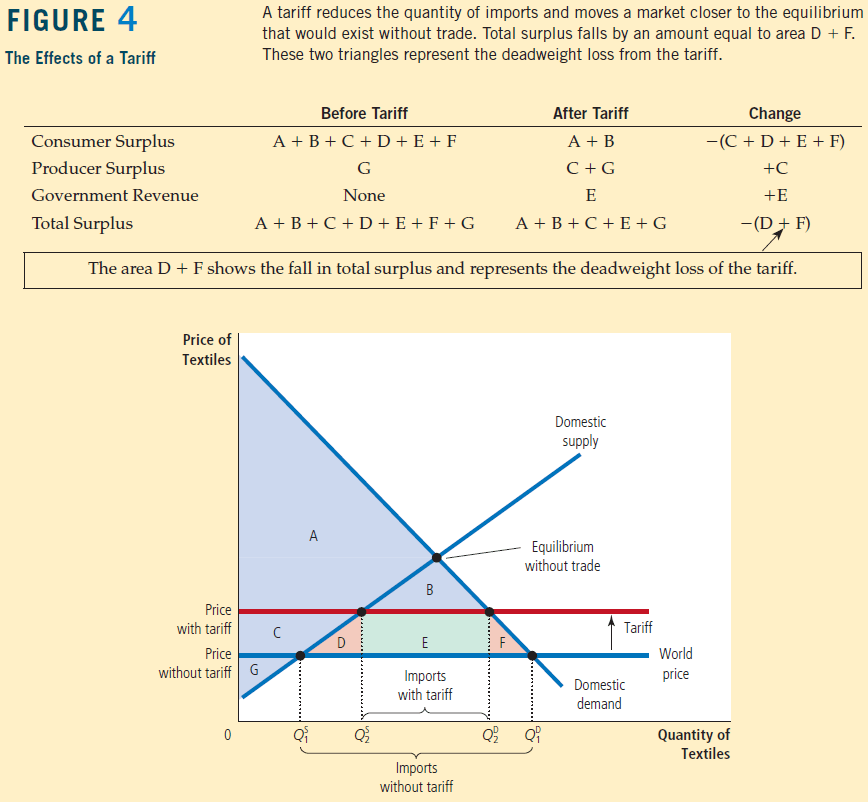

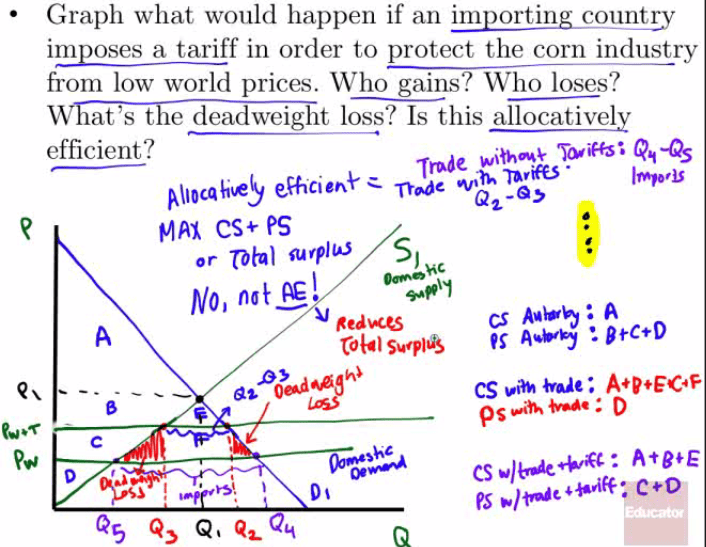

The Effects of a Tariff

Tariff

- a government tax on imports or exports

Example 1

Example 2